Allowable Itemized Deductions 2024 – However, if the sum of your allowable expenses is less than the standard deduction, it is better to take the standard deduction. The major categories of itemized deductions include: Sufficient . Each year, the IRS adjusts charitable gift rules, tax tables, personal exemptions, standard deductions and other tax provisions. This article highlights the key charitable figures for 2024. .

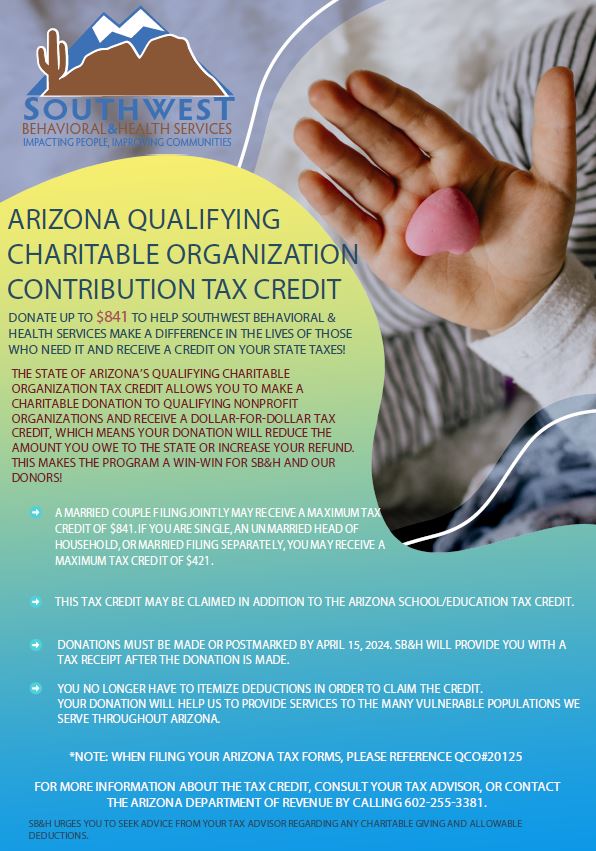

Allowable Itemized Deductions 2024

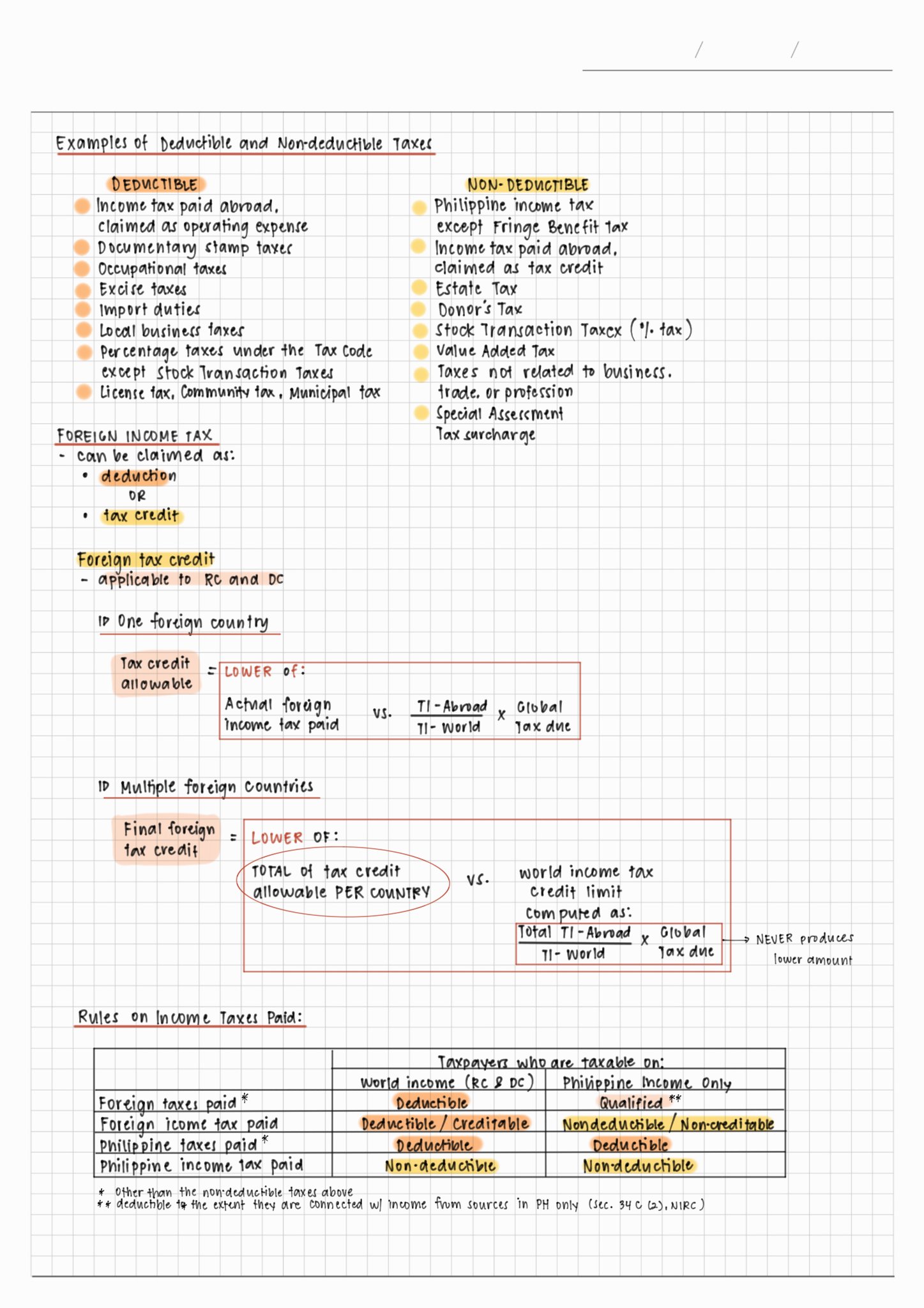

Source : www.investopedia.comArrietty, CPA on X: “Tax: Deductions from Gross Income Regular

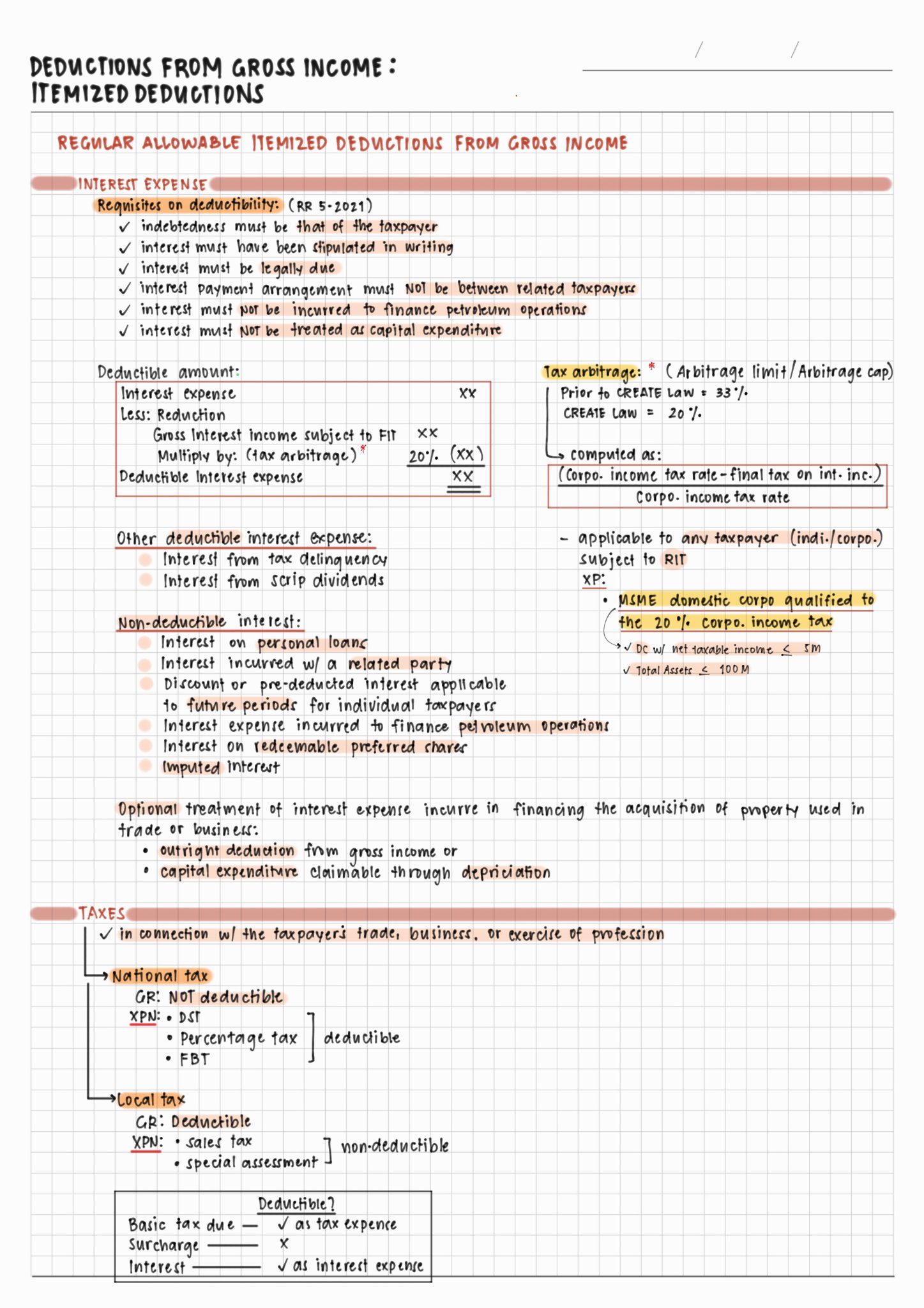

Source : twitter.comDonate | Southwest Behavioral & Health Services

Source : www.sbhservices.orgDonate | CASA Council | Ronald Stephan | Arizona

Source : casasupport.orgVITA Basic Exam 2024 with 100% correct answers Vita Stuvia US

Source : www.stuvia.com22 Popular Tax Deductions and Tax Breaks for 2023 2024 NerdWallet

Source : www.nerdwallet.comWhat Is an Itemized Deduction?

Source : www.thebalancemoney.comArrietty, CPA on X: “Tax: Deductions from Gross Income Regular

Source : twitter.comThe SALT Marriage Penalty Elimination Act: Revenue Estimates and

Source : www.heritage.orgGross Income & Allowable Deductions in the Income Tax Return YouTube

Source : www.youtube.comAllowable Itemized Deductions 2024 Tax Deduction Definition: Standard or Itemized?: Itemized deductions are specific expenses that you have incurred in allowable categories that can be used to reduce your tax bill. Like the standard deduction, the total of your itemized deductions . For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Here’s why. .

]]>:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

:max_bytes(150000):strip_icc()/itemized-deductions-3192880_final-c7961ca074b24a088e16ac74a2f20fc1.png)