Schedule C 2024 Tax Instructions – This story is part of Taxes 2024, CNET’s coverage of the best tax software You’re required to file a Schedule C form if you have income from a business, but it complicates your return and . Below is a list of our top tax software picks for the self-employed of January 2024. Whether you’re a The software also includes Schedule C preparation support—the form that sole .

Schedule C 2024 Tax Instructions

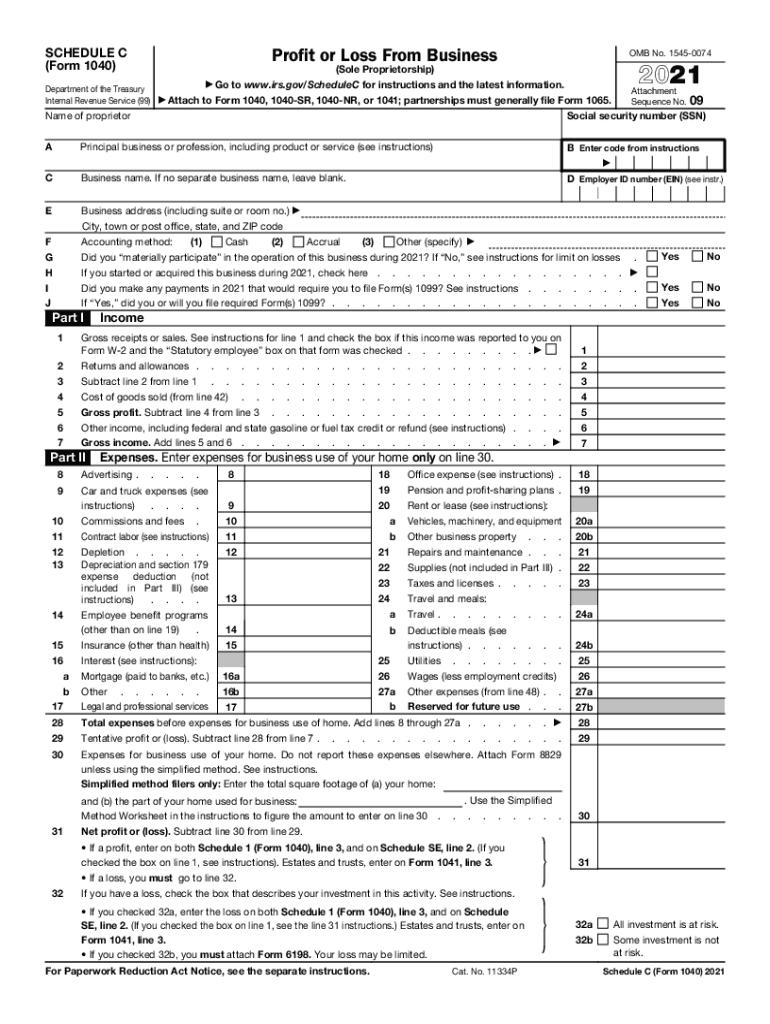

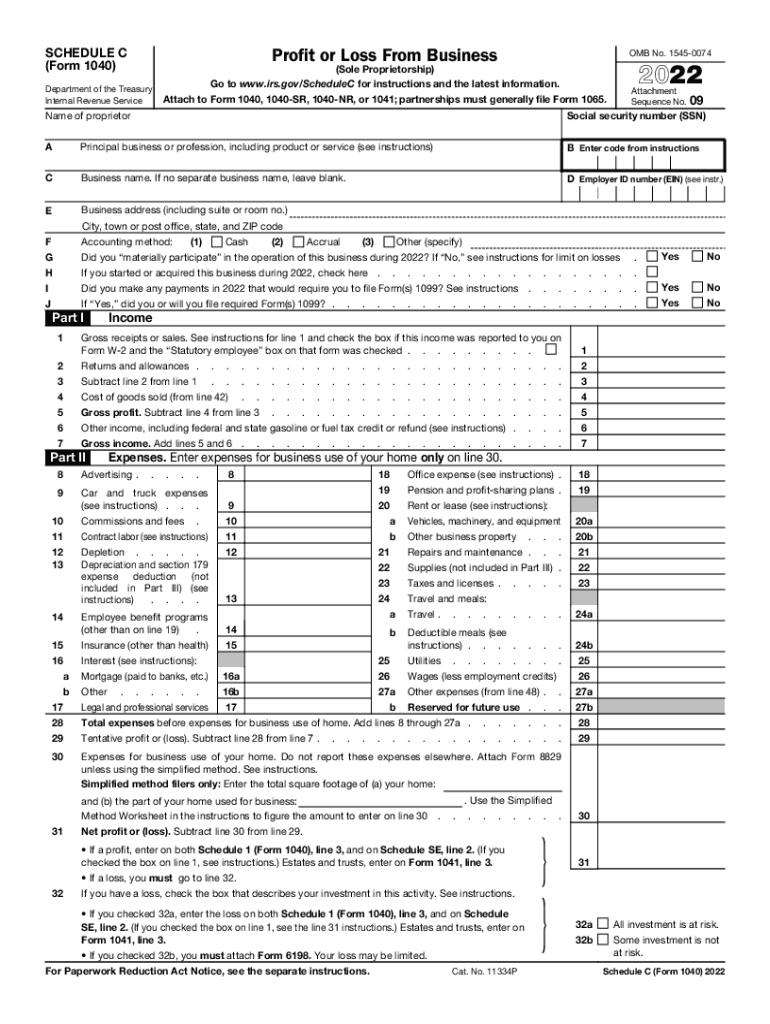

Source : www.kxan.com2023 Instructions for Schedule C

Source : www.irs.gov2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com1040 schedule c: Fill out & sign online | DocHub

Source : www.dochub.comWhere To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Source : studentaid.gov1040 gov: Fill out & sign online | DocHub

Source : www.dochub.comSchedule C Instructions [with FAQs]

Source : www.thesmbguide.comSchedule c form: Fill out & sign online | DocHub

Source : www.dochub.comFiling a Schedule C For An LLC | H&R Block

Source : www.hrblock.comSchedule C 2024 Tax Instructions Harbor Financial Announces IRS Tax Form 1040 Schedule C : Beyond personal asset protection, there are several LLC tax benefits to consider the IRS and issuing Schedule K-1s for members to use when filing their taxes. C corporation: LLCs may choose . Self-employed individuals pay the 12.4% on the first $160,200 of their net income in 2023 (the taxes filed in 2024 instructions regarding Schedule SE, which will help you figure out you tax .

]]>